ACE Flare Account debit cards offer several benefits and features. On the official website at www.aceflareaccount.com, you can apply for the card. In addition to transferring money, viewing transactions history, and many other things, you can apply for a license.

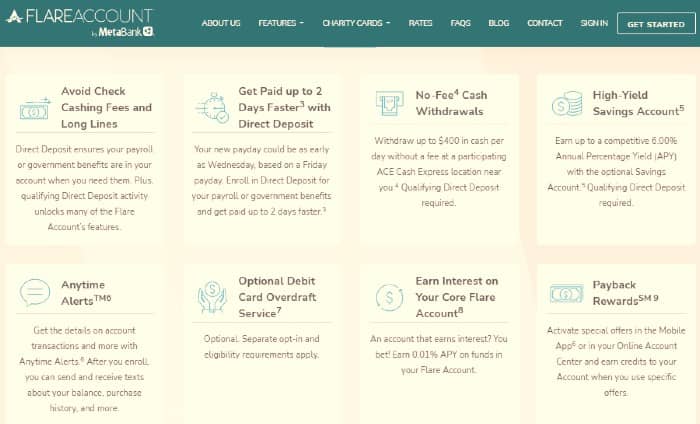

ACE Flare Debit Card Features

No Minimum Balance Requirement

A nice feature of the ACE Flare Account by MetaBank is that there is no minimum balance requirement to open or maintain the account. That doesn’t mean you should let it sit idle since you’ll be charged a monthly fee for doing so (see above).

Earn Interest

Let’s just be clear right off the bat. Since you are not investing in a mutual fund, the interest earned is minimal. However, you still get something for your money. At present, the ACE Flare Account offered by MetaBank offers a 0.01% annual percentage yield. This isn’t much, but you can earn more if you add on the ACE Flare Account by MetaBank Savings Account.

Solid ACE Flare Account by MetaBank mobile app

You can download the ACE Flare Account by MetaBank’s mobile app on both iOS and Android devices. Although the app is quite basic, it keeps you going. As well as sending money to others, depositing checks, checking your balance and purchase history, you can also access the Netspend Pre-Funded Check Service, which is optional. A feature of the app I like is the ability to get mobile text alerts when different things occur in my account.

Accessible customer support

ACE’s customer service can be reached by both telephone and email. However, their hours of operation were not listed, so I found that to be one of the problems. In essence, you’re sort of rolling the dice.

Electronic statements

The online account statements are available for you to access, just like any other traditional bank statement. Note, however, that if you don’t allow ACE to send you statements electronically, you will receive paper statements. You’ll be charged $5.95 for this, so make sure you register for electronic statements as soon as possible. Statements will only be provided if you made a transaction that month, otherwise, they will be issued quarterly.